In this article we take a look at how Credit Notes work on Accounts Payable.

If you have received a Credit Note from a Supplier and also have an Invoice to be paid from that supplier, follow these steps below.

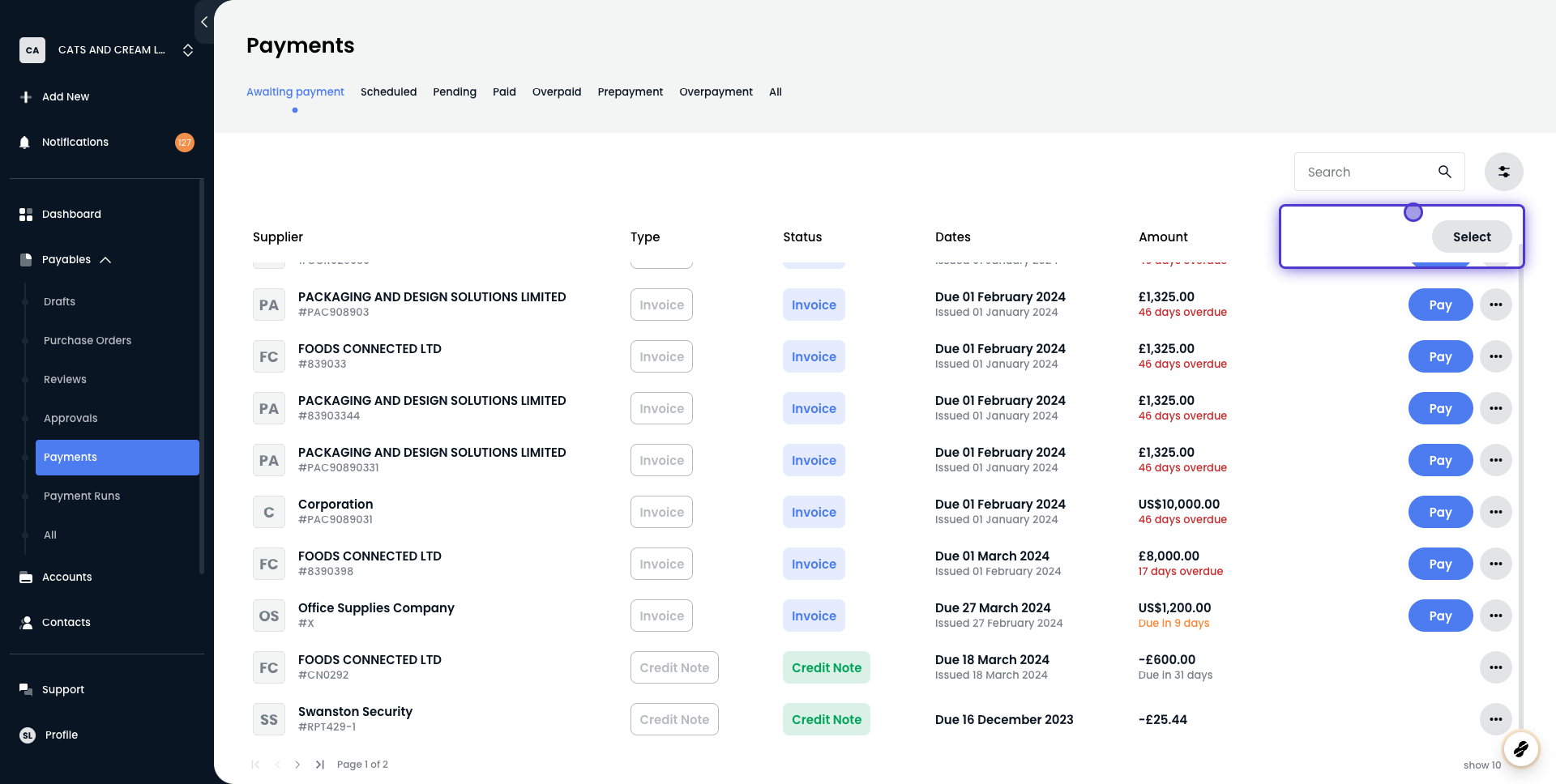

1. Go to Payments

How does my Supplier know I've applied a Credit Note?

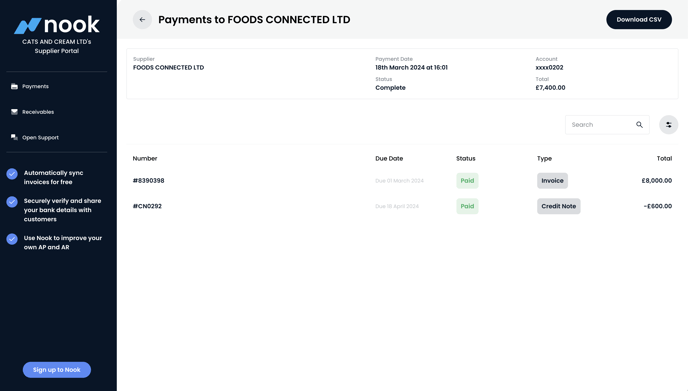

As pointed out above, your supplier will be paid a net amount (invoices-credit notes). In the remittance advice email they receive for that payment, it will look like this:

If they click into the supplier portal link, they will get a breakdown of all the invoices and credit notes for that payment:

How do you treat Credit Notes in my accounting software?

In your accounting software, we will create a Cash Refund for the supplier which will be auto-reconciled in your Accounts Payable GBP bank account.

(Xero example)